The Trusted Tax & Accounting Advisor For Your Business

Hey Tradespeople!

Did You Know There Are 7 Income Tax Reduction Strategies That Most Business Owners Miss Out On?

And Implementing Just ONE Of These Strategies Can Significantly Reduce Your Tax Bill, Increase Profits & Fast Track Your Path To Retirement...

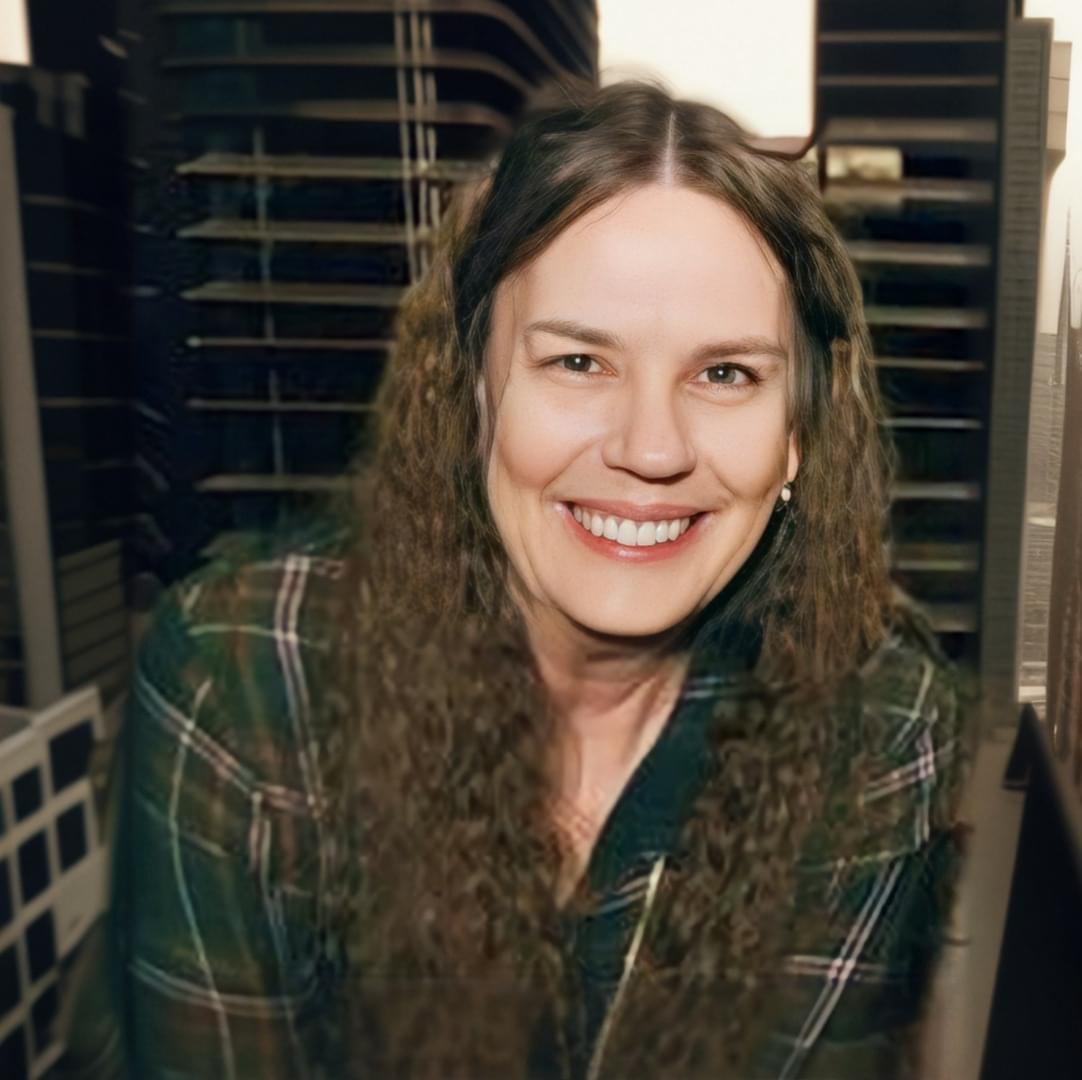

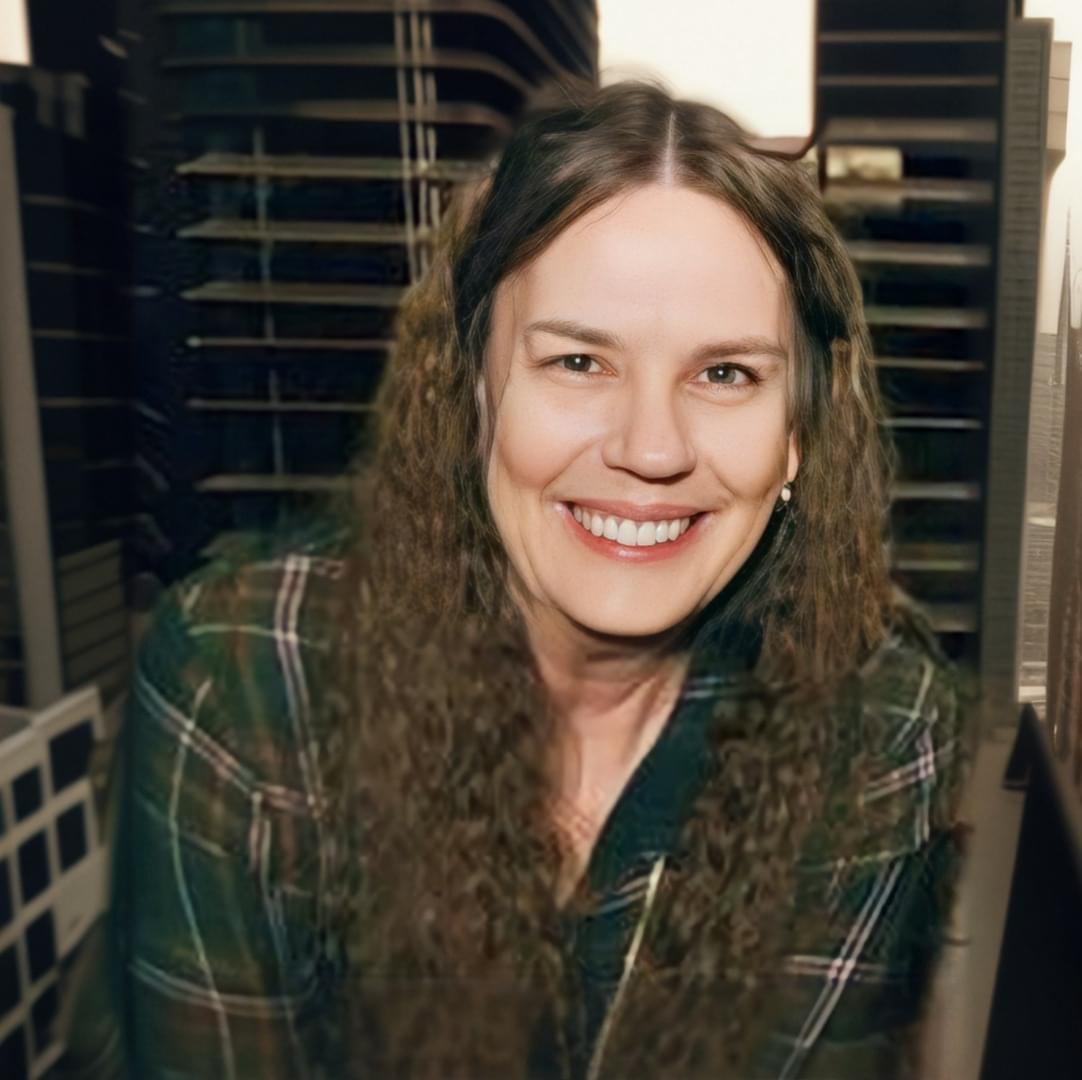

Jackie Humphrey, EA

Small Business

Accounting & Tax Advisor

From The Desk Of

Jackie Humphrey, EA

Hermann, MO

Dear Contractors,

Would you agree that running a trades business has become increasingly tough in recent years?

I’m sure you’ve felt the pressure…

On top of unpredictable market conditions, you have to deal with unexpected delays that can throw your budget completely off track…

Not to mention ever-increasing material costs that make it hard to know if you’ll make a profit on your jobs.

As an IRS Enrolled Agent who specializes in helping tradespeople owners increase profits and reduce taxes…

I understand the challenges you face when running your business.

The truth is, your income tax bill is the biggest challenge you face to achieving financial success for your business.

That’s because as a contractor or trades business owner, federal and state income taxes are the single biggest expense you have.

The problem is that most contractors are unaware that they can legally and ethically reduce their income taxes by up to 50%.

That's why I decided to write my latest book...and although originally written for plumbers, it actually applies to all tradespeople and contractors.

7 Legal Tax Loopholes For

Plumbing Business Owners

(P.S. It's not just for plumbers...

any small business, especially contractors, can use this information!)

Download Your Free Copy Of My eBook To See If You're Missing Out On One Of These Tax Reduction Strategies

Here's what you'll discover inside:

How to determine if your trades business is operating in the most tax-efficient entity structure (the wrong structure could be costing you an extra $10,000 - $100,000 per year).

Strategies to select the entity that’s most beneficial for your contracting business's unique ownership structure, ensuring maximum tax deductions and credits (you could be leaving thousands of dollars on the table annually).

How your business can pay each of your children up to $12,000 per year tax-free under the new income tax law.

Tax strategies to effectively lower your trades business's taxable income, all while motivating your workers and reducing employee turnover.

Retirement planning methods tailored for contracting business owners to decrease your taxable income by up to $100,000 (or even more) every year.

How to design and execute a plan that speeds up your retirement timeline and considerably lowers your business's taxable income annually.

Ways to transform your family trips into tax-deductible business expenses for your trades business.

How to convert taxable business income to tax-free personal income by renting your home to your contracting business for strategic meetings.

How to ensure all your personal medical, dental, and vision expenses are tax deductible by employing your spouse in your business.

Strategies to save a significant sum in Social Security and Medicare taxes yearly by fine-tuning your business's entity structure.

And much, much more!

Now Is The Time To Take Control

Of Your Finances And Your Future!

Download Your Free Copy Of My eBook Today...

7 Legal Tax Loopholes For

Plumbing Business Owners

I want to make sure you download your free copy of this ebook because it will show you 7 legal and ethical tax loopholes that could save you and your trades business $25-100k in taxes (or more) every single year...

So just click on the blue button above, enter your name and email address, and you'll get the pdf copy of the ebook in your inbox within minutes.

Talk soon,

Jackie Humphrey, EA

The Trusted Tax & Accounting

Advisor For Your Plumbing Business

Hey Plumbers!

Did You Know There Are 7 Income Tax Reduction Strategies That Most Plumbing Business Owners Miss Out On?

And Implementing Just ONE Of These Strategies Can Significantly Reduce Your Tax Bill, Increase Profits & Fast Track Your Path To Retirement...

Jackie Humphrey, EA

Plumbing Company

Accounting & Tax Advisor

From The Desk Of

Jackie Humphrey, EA

Hermann, MO

Dear Plumbers,

Would you agree that running a plumbing business has become increasingly tough in recent years?

I’m sure you’ve felt the pressure…

On top of unpredictable market conditions, you have to deal with unexpected delays that can throw your budget completely off track…

Not to mention ever-increasing material costs that make it hard to know if you’ll make a profit on your jobs.

As an IRS Enrolled Agent who specializes in helping plumbing business owners increase profits and reduce taxes…

I understand the challenges you face when running your business.

The truth is, your income tax bill is the biggest challenge you face to achieving financial success for your business.

That’s because as a plumber or plumbing business owner, federal and state income taxes are the single biggest expense you have.

The problem is that most plumbers are unaware that they can legally and ethically reduce their income taxes by up to 50%.

That's why I decided to write my latest book...

7 Legal Tax Loopholes For Plumbing Business Owners

Download Your Free Copy Of My eBook To See If You're Missing Out On One Of These Tax Reduction Strategies

Here's what you'll

discover inside:

- How to determine if your plumbing business is operating in the most tax-efficient entity structure (the wrong structure could be costing you an extra $10,000 - $100,000 per year).

- Strategies to select the entity that’s most beneficial for your plumbing business's unique ownership structure, ensuring maximum tax deductions and credits (you could be leaving thousands of dollars on the table annually).

- How your plumbing business can pay each of your children up to $12,000 per year tax-free under the new income tax law.

- Tax strategies to effectively lower your plumbing business's taxable income, all while motivating your workers and reducing employee turnover.

- Retirement planning methods tailored for plumbing business owners to decrease your taxable income by up to $100,000 (or even more) every year.

- How to design and execute a plan that speeds up your retirement timeline and considerably lowers your plumbing business's taxable income annually.

- Ways to transform your family trips into tax-deductible business expenses for your plumbing business.

- How to convert taxable business income to tax-free personal income by renting your home to your plumbing business for strategic meetings.

- How to ensure all your personal medical, dental, and vision expenses are tax deductible by employing your spouse in your plumbing business.

- Strategies to save a significant sum in Social Security and Medicare taxes yearly by fine-tuning your plumbing business's entity structure.

- And much, much more!

Now Is The Time To Take Control Of Your Finances and Your Future!

Download Your Free Copy

Of My eBook Today...

7 Legal Tax Loopholes For Plumbing Business Owners

So just click on the blue button above, enter your name and email address, and you'll get the pdf copy of the ebook in your inbox within minutes.

Talk soon,

Jackie Humphrey, EA